In this Demonetisation Essay, we have described the demonetisation in India with its history, impacts, advantages and disadvantages of Demonetization in India, etc.

In the process of demonetisation, a particular unit of currency is completely banned for use by the general public or members of the government.

The old currency is monetized in such a way that it becomes instantly invalid and has to be either replaced by the new currency issued against it or deposited in banks.

In this article Essay on Demonetisation, we had provided the various essays with different word limits, which you can use as per your need:

Essay on Demonetisation in India 250 words:

Demonetisation refers to the illegal use of currency as a legal tender by the government.

When a legal tender is demonetized by the government, it loses its value in the market, instantly becoming trash.

When a government withdraws the old currency from the market, it can issue a new currency.

Demonetisation information is kept confidential until the last day; otherwise, it would defeat the purpose of demonetisation on its own.

The main objective of demonetisation is to conflict tax avoidance and circulation of black money as well as counterfeit or fake currency.

If the notice of demonetisation is leaked in any way, it gives enough time to tax evaders and black money holders to convert their money into other legal forms like – land, gold, jewellery etc. will never reach banks.

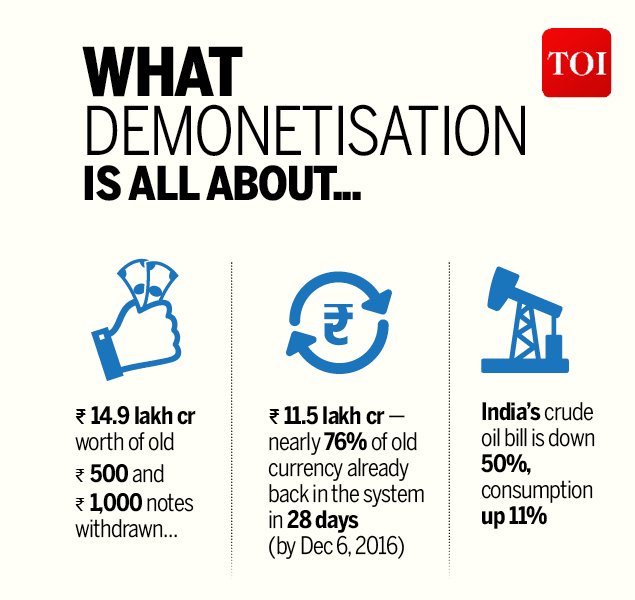

On November 8, 2016, at 8:15 PM, the Prime Minister of India, Shri Narendra Modi announced the Cabinet decision to ban 500 and 1000 denomination currency notes.

However, this was not the first time, and earlier demonetisation was effected in India in 1946 and 1978.

However, this moves support of banks but was criticized by political parties and other factions who thought it was unplanned and would only harm the nation’s economy.

Demonetisation Essay in English 250 words:

When a government legally cancels certain money, it is called demonetisation. The tender is usually replaced by the government with the new currency.

The Government of India had earlier announced demonetisation on three occasions – first in 1946, second in 1978 and third in 2016. Also, read Demonetisation Essay in 500 words.

Results of demonetisation:

Demonetisation has three main consequences – it employs tax elusion, it employs black money and ultimately it prevents or nullifies the value of the fake or counterfeit currency.

The move was directed towards an income that was not reported and thus survived taxation.

Indirect and unpublished funds of illegal activities such as human trafficking, smuggling, etc. were performed on a large scale.

Such funds were also used to fund anti-national activities such as Fatalism and terrorism.

The fake Indian currency was printed on India’s neighbouring Pakistan, the main source of terrorism in India, to destabilize the Indian economy as well as to fund terrorism and other anti-national activities on Indian soil.

Thus, the decision of demonetisation played an important role in preventing internal tax evasion and unaccounted theft of currency notes, as well as in preventing money to promote illegal and anti-national activities.

With the sudden termination of currency, those who have withdrawn large amounts of currency had no choice but to declare it and pay taxes.

Demonetisation Essay Conclusion:

The decision to demonetize would have been difficult for the common people of the nation, yet it was necessary.

It is better to stay in long queues in front of banks for some time than to leave the country at the mercy of foreign conspirators.

However, some groups criticized the move as a poor decision and a setback to the economy; Nevertheless, it was necessary to curb Nasal funding, Terror funding and unaccounted money in the Indian markets.

Demonetisation Essay in English 500 words:

When a country’s government legally bans coins, notes of a certain currency, this step is called demonetisation. Thus the restricted currency may or may not be replaced by the new currency.

Demonetisation aims to conflict many problems such as illegal activities and sources of their funding, fatalism, terrorism, illegal theft of currency, tax evasion and fake currency.

Demonetisation Date in India:

The Prime Minister of India announced the demonetisation on 8 November 2016 and this day, the 500 and 1000 rupee notes in the country were declared invalid.

However, this was not the first time, as India had seen demonetisation twice before.

The first demonetisation was implemented by the colonial rule on 12 January 1946, while being governed under the Government of India Act 1935.

It was decided by the government to ban 10-pound notes for checking tax evasion and other illegal activities.

The second decision of demonetisation was made on 16 January 1978 after independence, it was decided to demonetise the rupee currency notes i.e. Rs. 1000, Rs. 5000 and Rs. 10000.

But the last two occasions differ from the demonetisation of 2016 in such a way that the restricted currency was not replaced by a new one on the previous two occasions.

Demonetisation in India History:

(i) Demonetisation was not new to our country of India. For the first time in our country in 1946, it was decided to discontinue 500, 1000 and 10 thousand notes.

Even in the 1970s, the Wanchoo Committee on Direct Taxes Enquiry suggested demonetisation, but the suggestion became public, which led to the demonetisation.

(ii) In January 1978, the Janata Party government of Morarji Desai made law and closed the notes of 1000, 5000 and 10,000. However the then RBI Governor IG Patel opposed this note-halt.

(iii) In India, in 2005, the Manmohan Singh Congress government demonetized 500 notes before 2005.

(iv) In 2006 also Narendra Modi government decided demonetisation of 500 and 1000 notes. These two currencies occupied 86% of the Indian economy.

These notes were the most used in the market. For this reason, it led to such a huge disorder and consequence. Also, read Demonetisation Essay in 1000 words.

Effects and Benefits of Demonetisation in India:

Demonetisation has a great impact on the country’s economy. Since centuries governments have been using it as a tool to control corruption and other illegal activities.

Demonetisation drives the country’s economy out of fake currencies and brings unpublished money into the account.

It is a measure that is taken into account with several objectives. Taking it as a single objective would be a misconception.

In general, it serves as a countermeasure for various illegal as well as anti-national activities, the main objective was to prohibit counterfeit currency which was roaming the Indian market.

Apart from limitation fake currency, the move was also aimed at bringing undisclosed funds back into the mainstream.

India had been dealing with fatalism for decades. Indian Naxalites receive funds from various sources inside and outside India.

The money used to finance the anti-national movement remains out of the reach of tax agencies and is certainly in large denominations i.e. Rs. 500 and Rs 1000.

The rapid demonetisation of this money of 1000 currencies resulted in the currency becoming useless, leading to the financing of anti-national and illegal activities.

Also, read 1. Indian Education System Essay 2. Make in India Essay 3. Essay on GST

Conclusion of Demonetisation:

Demonetisation is not new to the world, governments around the world have been taking demonetisation decisions from time to time.

However, the currency that was demonetized may vary, but largely the objective is inflation, combating black money, curbing illegal activities, getting fake currency out of the economy, unaccounted money under the scrutiny of tax agencies.

Essay on Currency Demonetisation in 1000 words:

Governments decide to disable specific value notes or coins to counter inflation and other illegal activities.

It also works as a measure to deal with various issues that hamper the overall development of the country.

Impact of Demonetisation on Indian Economy:

While demonetisation shook the economy for a while, while many positive short-term effects of demonetisation are visible, the total effects of demonetisation on the surface will take five to six years.

Demonetisation had several positive effects on India’s economy, reduction black money back into the mainstream, anti-national and illegal activities, etc.

However, it also caused a high amount of confusion and misunderstanding. Some of the disreputable after demonetisation effects include cash shortages, long queues in front of banks and ATMs, declining stock market and declining industrial production.

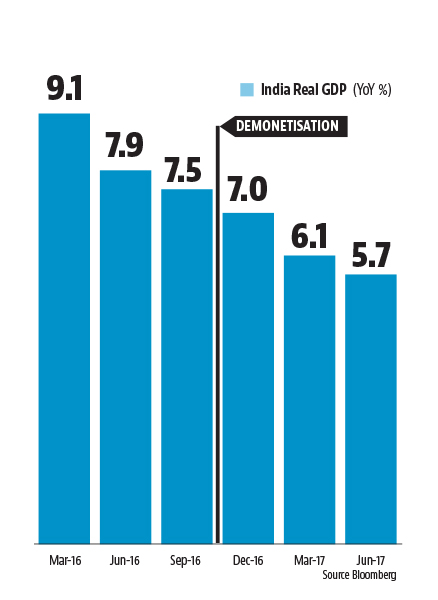

Some experts claim that by reducing GDP (GDP), demonetisation has adversely affected the Indian economy, as many small and medium enterprises have closed their businesses due to lack of cash.

Black Money Came Out:

Despite all the mentioned adverse effects of demonetisation, it regained 99% of the money reported to tax agencies.

During demonetisation, a total of Rs 15.28 lakh crore was deposited in bank accounts including the Jan Dhan accounts of the poor.

The wealth tax in the Jan Dhan accounts was deposited by the thieves, who did so to avoid losing their wealth.

This amount, which till now was lying idle in lockers, immediately became taxable, boosting the economy.

Demonetisation also successfully controlled the practice of fake notes. After the demonetisation, the number of fake notes was at least 0.0035%. Also, read Demonetisation Essay conclusion.

Means of Fighting Corruption and Anti-national Activities:

Demonetisation was a decision that had short-term inconveniences but long-term benefits for the Indian economy.

Short-term inconveniences include a shortage of cash, long queues at banks and ATMs.

The long-term benefits of demonetisation in the Indian economy will reduce – leading to anti-corruption and anti-national activities, the digital economy and more savings, ultimately GDP.

An effort for a Cashless Economy:

Income tax returns increased from 43.3 million to 52.9 million after demonetisation. One of the major effects of demonetisation was that it made a digital payment effort in India.

Long queues took place and due to shortage of cash people thought better to adopt digital technology.

It also acted as a speed breaker for corruption. The illegal exchange of funds between the corruption convenors led to a ban in government as well as private sectors.

Large amounts of money, which was stuck in the form of bribes and for other similar activities, immediately became worthless and either had to be deposited in banks or thrown away.

Also, read 1. Digital India Essay 2. Swachh Bharat Abhiyan Essay 3. Cashless Economy Essay

Merits of Demonetisation:

The Government of India demonetized currency notes of 500 and 1000 rupees in a historic decision. Before demonetisation on 8 November 2016, there was a high volume of black and fake notes in the Indian market.

Also, individuals and agencies had high amounts of unpublished currency available in the form of hard cash.

It was necessary to mainstream such fake and undisclosed money to strengthen the country’s economy and banking system.

Bringing untaxed money into the mainstream:

Before the demonetisation, many fair players in the Indian economy were out of the trend of the banking system.

They were formed by small farmers, traders and the need to bring them back into the mainstream.

Control Corruption:

Unaccounted and undisclosed wealth deals with corruption, this unauthorized money in high amount was not only promoting corruption but also weakening the Indian rupee.

Demonetisation was needed to curb corruption as well as strengthen the Indian rupee in the international market. Also, read Demonetisation Essay conclusion

Promoting Cashless Economy:

Demonetisation was effective in many ways. Initially, it caused confusion and misunderstanding due to lack of new currency and long queues in banks and ATMs.

However, this decision also had some positive effects. Indian demonetisation of 2016 was effective in making India a cashless economy.

Due to a shortage of cash and long queues outside banks, people and businesses turned to digital transactions.

Any digital transaction falls under the government’s radar, ultimately resulting in more tax payments and less proliferation of unaccounted money in the market, later, banks were strengthened and the economy improved.

Paved the Way for Digital Transactions:

In many cities, digital transactions had doubled post demonetisation.

Digital payment gateways like Paytm and MobiKwik have recorded unprecedented growth in the number of users.

Apart from the increase in digital transactions across India, there was also a high amount of old currency deposits, bringing it back into the mainstream.

According to the records, during the period of demonetisation more than three trillion rupees were deposited in banks. Also, read Demonetisation Essay FAQ.

Demonetisation Performance:

Although the move to demonetisation was supported by banks and some international commentators, it also faced criticism from various parties within India.

Many opposition parties believed the move useless. Critics were of the view that demonetisation would promote economic growth, rather than promoting it.

Long queues of people outside the banks became an issue by the political class, posing as an inhuman and anti-poor.

He claimed that the real owners of black money had already called meetings to exchange their illegal money with banks, thus there was a shortage of cash.

The government was also accused of poor planning and management.

A Public Interest Litigation (PIL) was also filed in the Madras High Court by the Indian National League, requesting the quashing of the condemnation verdict;

However, the Court refused to interfere with the government’s monetary decision.

Demerits of Demonetisation:

1. Tourism destinations suffered the most due to lack of local money. Many people also cancelled their tour of India. There was a slowdown in work.

2. There is a problem in everyday life of common men. Standing in front of banks and ATMs for hours, faced hospital bills, electricity bills, rental problems, and many more.

3. People could not do weddings with as much ceremony as they thought.

4. In today’s time, many questions are being raised on demonetisation. Some people say that demonetisation has failed.

It is a scheme in which black money is made white. Some people say that there has been no benefit. India’s economic growth rate has come down from 7.5 to 6.3.

5. a lot of money was spent printing new notes but terrorist funding is still ongoing. We cannot even avoid those allegations, perhaps the level that was expected from the note-ban was not achieved.

Also, read 1. Unity in Diversity 2. Value education 3. National Integration

Conclusion:

The decision of demonetisation may have inconvenienced the common people, it certainly had a national interest and economic development at its core.

India has been under fatalism and terrorist activities for decades, Demonetisation, although putting the interest of the country in danger for a certain period, has simultaneously attacked the problems of black money and Nasalize financing.

Now it is ensured that most of these problems have been eliminated and in future, we will see no decrease in India’s growth rate due to these problems, that is, our country will grow faster.

• Section Under Essays