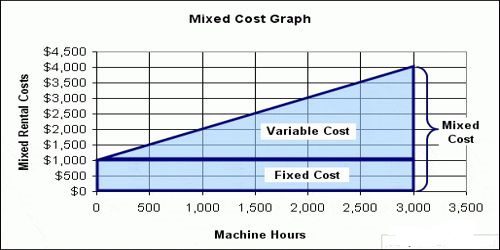

Fixed cost is referred to as the fixed total regardless of the number of units produced whereas variable cost is referred to the amount of output produced that affects variable costs.

Fixed costs are those that do not fluctuate with the level of activity in the short term while Variable cost refers to the cost of components that vary according to the level of activity.

Here are some of the main differences between the fixed and variable costs to help you understand how both differ:

Fixed Cost Vs Variable Cost:

What is Fixed Cost?

A fixed price is defined as a price that does not fluctuate as the number of goods produced by the company increases or decreases. Fixed costs are costs that a corporation must bear regardless of production level.

The fixed costs are less manageable than variable costs because they do not affect quantitative production factors.

Fixed expenses include rent, salary, property taxes, etc.

What is Variable Cost?

A variable cost is one that fluctuates in response to variations in production levels.

The variable price of a corporation increases or decreases according to the proportion of the product.

The expense of raw materials used in production, sales incentives, labour costs, and other factors are examples of variable costs.

What is the Difference between Fixed Cost and Variable Cost?

Fixed costs are expenses that are cast in concrete for a defined length of time and are unaffected by the performance of the firm whereas Variable costs change over time and are frequently tied to business operations.

So, what’s the difference? Let’s discuss the difference between fixed and variable costs and how they are similar but not the same.

| Fixed Cost | Variable Cost |

| Fixed cost is defined as an expense that does not fluctuate as the number of items produced by a company increases or decreases. | A variable cost is a type of expense that fluctuates in response to recent growth. |

| It is time-dependent and changes after a certain period of time have elapsed. | It is volume-dependent and varies according to the amount of material produced. |

| Despite the number of units produced, fixed costs are associated. | Variable costs are incurred as units are manufactured. |

| The fixed cost decreases as the number of units produced increases. | Regardless of the number of production units, variable cost remains constant. |

| Increased output lowers expenses and raises profits. | There is no influence on profit due to the volume of manufacturing. |

| Rent, salary, and property taxes are all expenses. | Costs of labour, raw materials, and marketing fees are all things to think about. |

| Expenses in the areas of production, administration, trading, and marketing are all fixed. | Direct Material, Direct Employment, and Direct Costs, Variable Production Costs, Variable Marketing, and Distribution Operational costs, Direct Material, Direct Human labour, and Direct Expenses. |

Conclusion:

You learned a lot about the differences between fixed and variable costs by reading this article.

It may be obvious that the two costs are diametrically opposed to one another and are not comparable in any way.

Understanding fixed and variable costs as part of comprehensive business costs is critical for developing long-term accounting systems as a business person.

• Section Under Diff